7 instant personal loan mobile apps in 2025:-व्यक्तिगत ऋण कई कारणों से लिया जा सकता है, जिसमें शादी, छुट्टी पर जाना या अपने प्रियजन के लिए कोई महंगी वस्तु खरीदना या कोई आपातकालीन स्थिति शामिल है।

7 instant personal loan mobile apps in 2025

यहां हम कुछ लोकप्रिय पर्सनल लोन ऐप्स की सूची दे रहे हैं, जिन्हें नए साल में इस्तेमाल किया जा सकता है।

1-Bajaj Finserv:-

- Loan Amount: Offers the highest loan amount range (₹1,000 to ₹25 Lakh), suitable for both personal and business loans.

- Interest Rate: Starts at 13% p.a., which is competitive for larger loan amounts.

- Repayment Tenure: Offers the most flexible tenure, ranging from 12 to 60 months.

- Disbursal Time: Disburses loans within 24 hours, ideal for individuals needing larger loans.

2-KreditBee:-

- Loan Amount: Provides smaller loan amounts (₹1,000 to ₹2 Lakh), making it ideal for short-term personal needs.

- Interest Rate: The interest rate is relatively higher (18% to 36% p.a.), reflecting the short-term nature of the loans.

- Disbursal Time: Offers instant disbursal (within minutes), which is great for quick financial needs.

3-EarlySalary:-

- Loan Amount: Offers loans from ₹8,000 to ₹5 Lakh, making it a good option for individuals needing moderate-sized loans.

- Interest Rate: Interest rates are around 18% p.a., which is standard for short-term loans.

- Disbursal Time: Loans are disbursed within 30 minutes, providing quick relief in emergencies.

4-PaySense:-

- Loan Amount: Provides loans ranging from ₹5,000 to ₹5 Lakh, suitable for both small and medium loan needs.

- Interest Rate: Starts at 16% p.a., which is competitive for the loan amounts offered.

- Repayment Tenure: Offers flexible repayment terms ranging from 3 to 24 months.

- Disbursal Time: Instant disbursal, which is ideal for individuals needing funds urgently.

5-Navi:-

- Loan Amount: Navi offers loans between ₹10,000 to ₹20 Lakh, making it ideal for those who need larger loan amounts.

- Interest Rate: One of the lowest interest rates in the market, starting at 9.99% p.a..

- Disbursal Time: Instant approval and disbursal, ensuring that you get quick access to funds when needed.

- Loan Type: Best suited for personal loans and on-demand loans.

6-MoneyTap:-

- Loan Amount: Offers loans from ₹3,000 to ₹5 Lakh, ideal for those needing flexible loans for various personal expenses.

- Interest Rate: Starts at 13% p.a., competitive with other platforms.

- Disbursal Time: Instant disbursal, making it a convenient app for emergencies.

- Loan Type: Unique offering of on-demand loans, allowing users to borrow money as needed.

7-CASHe:

- Loan Amount: Offers loans starting at ₹1,000 up to ₹5 Lakh, focusing on small to medium loan needs.

- Interest Rate: Interest rates start at 2% per month (~24% p.a.), which is slightly higher than some other apps.

- Repayment Time: Loans come with flexible repayment options from 3 to 12 months.

- Disbursal Time: Instant disbursal, ideal for people in need of quick loans.

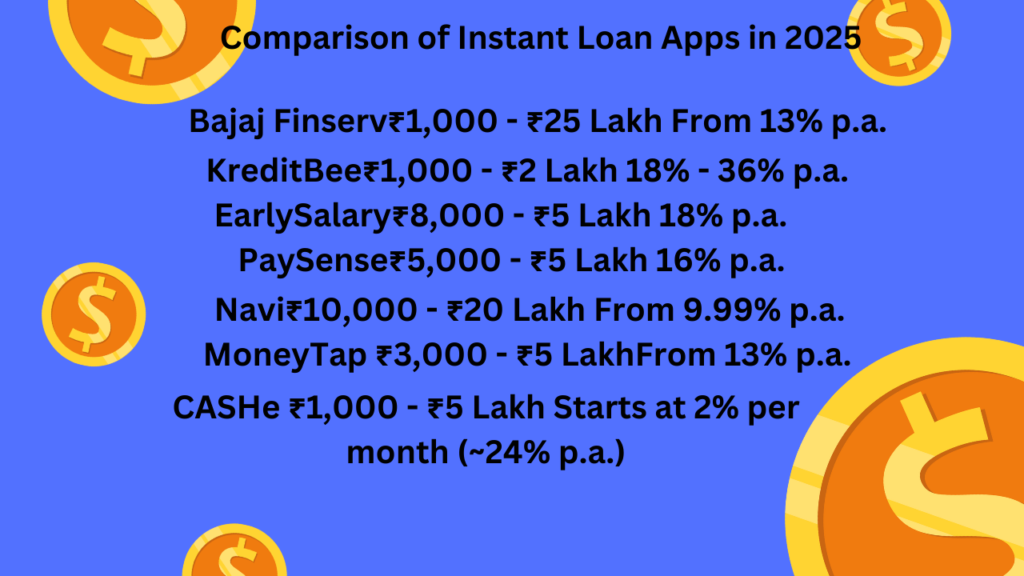

Comparison of Instant Loan Apps in 2025

Choosing the Best loan App for You

- For Larger Loan Amounts (₹1 Lakh – ₹25 Lakh):

- Best Options: Bajaj Finserv and Navi

- If you need a larger loan amount for personal or business purposes, Bajaj Finserv and Navi provide the best flexibility and low interest rates.

- For Smaller Loan Amounts (₹1,000 – ₹2 Lakh):

- Best Options: KreditBee and CASHe

- If you’re looking for a small, quick loan with a fast disbursal time, KreditBee or CASHe are great choices.

- For Emergency/Short-Term Loans:

- Best Options: EarlySalary, MoneyTap, and PaySense

- For quick emergency loans, EarlySalary and MoneyTap provide the fastest disbursal with minimal documentation.

- For Low-Interest Personal Loans:

- Best Option: Navi

- Navi offers competitive interest rates starting at 9.99% p.a., which is one of the best in the market.

Comparison of Instant Loan Apps in 2025

| Feature | Bajaj Finserv | KreditBee | EarlySalary | PaySense | Navi | MoneyTap | CASHe |

| Loan Amount | ₹1,000 – ₹25 Lakh | ₹1,000 – ₹2 Lakh | ₹8,000 – ₹5 Lakh | ₹5,000 – ₹5 Lakh | ₹10,000 – ₹20 Lakh | ₹3,000 – ₹5 Lakh | ₹1,000 – ₹5 Lakh |

| Interest Rate | From 13% p.a. | 18% – 36% p.a. | 18% p.a. | 16% p.a. | From 9.99% p.a. | From 13% p.a. | Starts at 2% per month (~24% p.a.) |

| Loan Tenure | 12 months to 60 months | 2 to 12 months | 3 to 12 months | 3 to 24 months | 6 to 36 months | 3 to 24 months | 3 to 12 months |

| Disbursal Time | Instant (within 24 hours) | Instant (within minutes) | Within 30 minutes | Instant (within minutes) | Instant (within minutes) | Instant (within minutes) | Instant (within minutes) |

| Eligibility Criteria | Salaried/self-employed, good credit score | Salaried professionals, good credit score | Salaried professionals, students | Salaried/self-employed individuals | Salaried/self-employed individuals | Salaried professionals | Salaried professionals |

| Documentation | Minimal (Aadhaar, PAN, income proof) | Minimal (Aadhaar, PAN, income proof) | Minimal (Aadhaar, PAN, income proof) | Minimal (Aadhaar, PAN, income proof) | Minimal (Aadhaar, PAN, income proof) | Minimal (Aadhaar, PAN, income proof) | Minimal (Aadhaar, PAN, income proof) |

| Loan Type | Personal, Business, Loan Against Property | Personal, Payday Loans, EMI Loans | Personal Loans, Salary Advance | Personal Loans, EMI Loans | Personal Loans, On-Demand Loans | Personal, Flexi Loans | Personal Loans, Salary Loans |

| Repayment Options | EMI, flexible tenure | EMI, flexible tenure | EMI, flexible tenure | EMI, flexible tenure | EMI, flexible tenure | EMI, flexible tenure | EMI, flexible tenure |

| Credit Score Requirement | Moderate to high (650 and above) | Moderate (650+), but flexible | Moderate to high (650 and above) | Moderate to high (650+) | Moderate to high (650+) | Moderate to high (650+) | Moderate to high (650+) |

| Processing Fee | 1% to 2% of loan amount | 1% to 2% of loan amount | 2% to 3% of loan amount | 1% to 3% of loan amount | 1% to 2% of loan amount | 1% to 2% of loan amount | 1% to 2% of loan amount |

| Prepayment Charges | No prepayment charges | No prepayment charges | No prepayment charges | No prepayment charges | No prepayment charges | No prepayment charges | No prepayment charges |

| Mobile App Rating | 4.2/5 on Play Store | 4.3/5 on Play Store | 4.2/5 on Play Store | 4.3/5 on Play Store | 4.2/5 on Play Store | 4.2/5 on Play Store | 4.2/5 on Play Store |

Click Here for other loan apps Details